Let’s dive in and take a look at the Best WooCommerce Payment Gateway for WordPress in 2019. One of the first things you’ll need to decide on when building your WooCommerce store is which payment gateway you’re going to use.

Finding the right WooCommerce Payment Gateway is one of the most important tasks to get right with any eCommerce store.

Why?

Your chosen payment gateway has a huge impact on your customers checkout experience. It also has a massive impact on how you as the business owner gets paid! Before we go any further let’s actually explain what a payment gateway actually is and why it’s so important.

What is a Payment Gateway?

If your online store was a bricks and mortar coffee shop, your payment gateway is your cash register. Simply put, your Payment Gateway is the piece of technology that lets you accept payments from your customers. It’s called a gateway because technically it’s the main conduit between your online store and all the major credit card providers and banks who issue those cards to customers. The Payment Gateway is responsible for ensuring that your customers payment details (such as Credit Card Numbers, Expiry dates and CVV/CVN numbers) are securely transmitted to the relevant payment processor. The is also then responsible for letting WooCommerce know if a payment is successful or not, which is then processed within WooCommerce.

Without a payment gateway in place you wouldn’t be able to securely take payments from your customers. Therefore, it’s essential to get this piece of your critical eCommerce infrastructure right.

What are the different types of Payment Gateway?

There are many different types of Payment Gateways available to choose from. Each has it’s own unique pros and cons. Let’s take at the pros and cons of the most common types of Payment Gateways.

Form based Payment Gateways

Form based Payment Gateways have traditionally been the easiest type of payment gateway to get up and running. With a form based gateway when a user clicks “Buy” the actual payment step typically happens off your online store on the gateways own secure payment page. The major advantage of this type of gateway is that it means you significantly simplify the technical requirements for getting your online store up and running as quick as possible.

If you can’t get an SSL certificate for whatever reason (and really there’s no excuse NOT to have an SSL cert anymore!) then form based gateways are pretty much your only choice.

There are 2 major disadvantages for form based payment gateways:

- User experience friction – the payment page will quite often look quite different from your own website. This can be a jarring experience for your customers. When your customer suddenly sees a completely different looking payment page they may think they’ve been redirected somewhere they shouldn’t be – and it could lead them to abandoning their purchase. Over the years we’ve seen lower conversion rates on some form based gateways for exactly this reason.

- Lost transactions – It’s more common to see issues with lost transactions with form based gateways. As you’re sending traffic away from your store, not all of these will make it back. Even if the user completes the payment on the gateway purchase page, sometimes you’ll end up with customers who close the page before being redirected back to your online store – hence transactions sometimes get lost. There can also be issues with timeouts when redirecting traffic from one endpoint to another which can lead to lost transactions.

iFrame based Payment Gateways

These are similar to form based gateways but instead of being redirected to a separate page, the payment gateway loads a secure payment form within an iFrame on your online store. The form is still being managed and served from the payment gateways own website, but because it’s in an iFrame it appears like it’s being served from your website – which helps to mitigate the 2 key disadvantages of form based gateways.

Direct Payment Gateway

This direct payment gateway basically means that the customer sees a payment form directly on your online store. The payment process is seamlessly integrated into your website. The major advantages of this type of gateway are:

- your payment process looks more professional and trustworthy than any other type of gateway

- your conversion rates will be higher as there is little to no friction in the final steps of the checkout process

- the scope for lost transactions is minimized as WooCommerce and your payment gateway communicate directly and securely and can handle lots of different payment status scenarios (e.g. display “Incorrect CVN number – please try again”)

The biggest disadvantage of direct payment gateways is that you now have a lot more responsibility for the security of your payment process. While it’s still the case that the gateway is responsible for validating and authorizing the transaction your online store may now be responsible for encrypting and transmitting the customers payment details. If that is the case you may now need to be PCI compliant – which can incur significant additional cost to your business. At a minimum you will almost certainly require an SSL certificate to use a direct payment gateway.

Which one is the best Payment Gateway for WooCommerce?

My recommendation is to always aim for a direct payment gateway as it is what most customers now expect and demand from a checkout process. The good news is that some of the larger payment gateway providers are making it easier to deploy direct gateways that are PCI compliant meaning that it’s possible to get the best possible checkout experience without incurring the cost of PCI compliance.

So just who are the biggest Payment Gateway providers for WooCommerce?

- Stripe

- Paypal

- Braintree

- Authorize.net

- Sagepay

Stripe

Stripe is by far my favourite Payment Gateway for any eCommerce platform. Founded in 2010 by two of the smartest Irishmen on the planet, Patrick and John Collison, Stripe have been single handedly responsible for turning the payment gateway industry on it’s head. If you built eCommerce websites in the pre-Stripe era, you’ll remember how much of a pain in the arse it was to integrate pretty much any gateway. Payment gateways typically threw SDK integration guides that were sometimes over 200 pages long at you and said good luck! Stripe won the hearts and minds of developers everywhere by making it as simple as adding a couple of lines of Javascript to your site and you were done. Winning developer mindshare early on has led to rapid growth for Stripe. It may well have been the fastest growing business of all time to reach a billion dollar valuation.

The official Stripe extension for WooCommerce is without question the best checkout experience for WooCommerce. With Stripe, customers stay on your store during checkout instead of being redirected to an externally hosted checkout page. But they also do this without you needing to go through your own PCI compliance by using Stripe Elements. Think of Stripe Elements as a completely new type of hybrid payment gateway that has all the benefits of a direct gateway but also ensuring you’re not bogged down with expensive PCI auditing.

Stripe has no setup fees, no monthly fees, and no hidden costs. Pricing is approx. 2.9% and an additional 30 cents per transaction.

Disadvantages of Stripe?

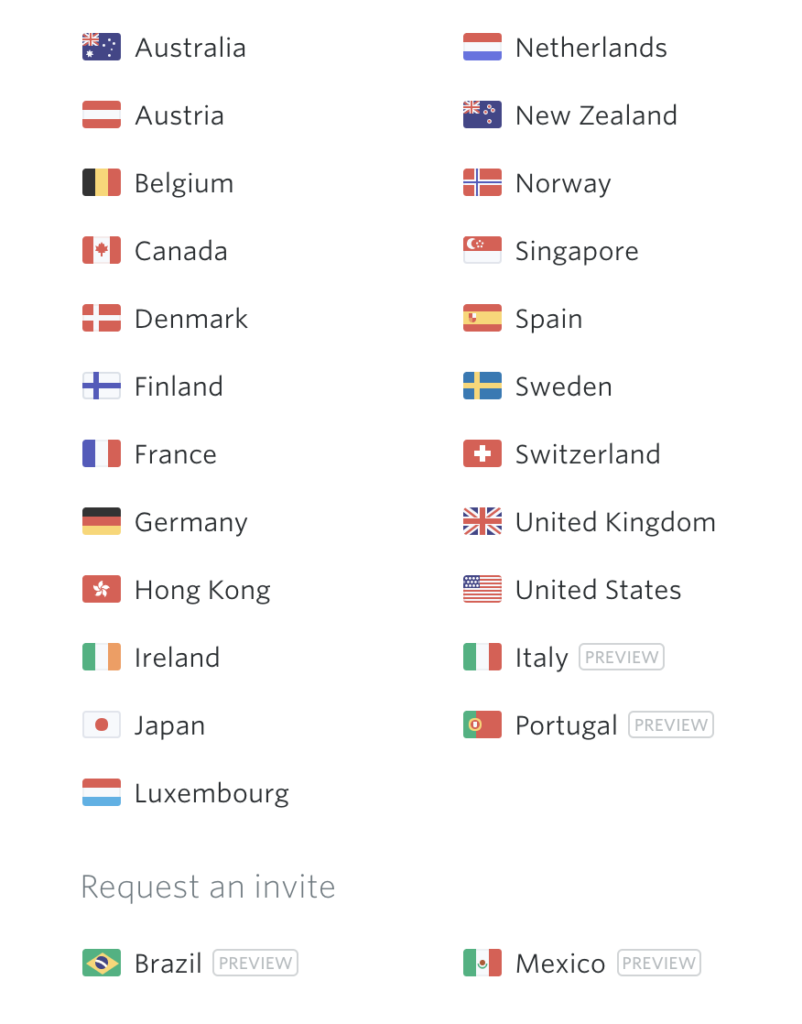

The biggest disadvantage historically for Stripe has been it’s limited availability. As a rapidly growing new entrant to the industry, Stripe started off as a US only option. It then grew to add major international markets like the UK. As of early 2018,

Stripe is now available in 25 countries.

Thankfully this major disadvantage is becoming less and less of an issue as more countries become available. The only other slight concern with Stripe would be their ability to keep up with their rapid growth. There have been times over the past few years with the customer support experience has been lacking. Most of this can be attributed to simply growing too fast and things seemed to have become far more reliable over the past year or two.

Get the official Stripe extension for WooCommerce here.

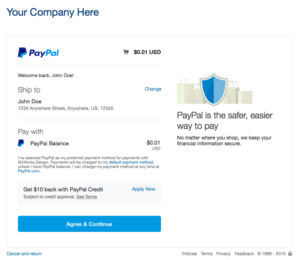

Paypal

Paypal is still to this day to the undisputed king of global payment gateways. For many getting started with their first online store, Paypal is their first payment gateway. Why? Because it’s so damn easy to start using in a few minutes. Paypal is also directly integrated into WooCommerce core (called Paypal Standard) meaning you don’t need any additional extensions to start using Paypal. The core WooCommerce/Paypal integration uses the form based gateway method. So while it’s very simple to get started – it is by no means the optimal checkout experience for your customers. I would recommend using Paypal Standard only if you’re in a real rush to get started and want to quickly test out a new market. The good news is that if you’re going to introduce friction into your checkout process make sure it’s with Paypal – as many people who shop online will be familiar with the Paypal payment screen.

Depending on your transaction volume, Paypal usually ends up being slightly more expensive than Stripe – around 3.4% and 35 cent per transaction. This will vary though based on sales volume.

The other good news is that the innovations brought to the market by the likes of Stripe has forced Paypal to really up it’s game and improve their product offering a lot over the past few years. They still have a long way to go in some areas but it’s clear that they’re not going to rollover and let Stripe take over the market – which can only be good for WooCommerce store owners everywhere.

WooCommerce also have a separate Paypal Pro WooCommerce extension which incorporates Paypal’s direct payment gateway. This obviously will mean you need the all important SSL certificate. Unfortunately at this time this extension will only be useful to you if you are a US, UK or Canada Paypal Pro customer.

Get the official Paypal Pro extension for WooCommerce here.

Braintree

Founded in 2007, Braintree was another relatively new entrant to the payment gateway industry. Paypal acquired Braintree in 2013 for over $800m. The major advantage of using Braintree vs. Paypal is your revenue goes directly to your bank rather than your Paypal account. If you can’t use Stripe or Paypal Pro, Braintree would be my next recommendation. While their vetting process can be slightly more in-depth than the Paypal or Stripe vetting process, their support experience tends to be superior. Their API’s and gateway options are also on a par with anything Paypal itself provides. Braintree tends to be more expensive than both Paypal and Stripe despite their main pricing suggesting they are cheaper. (Mainly due to some additional charges depending on your specific merchant account requirements). But for those who can’t use Stripe or Paypal Pro, Braintree is probably still your best alternative.

Check out Braintree for WooCommerce

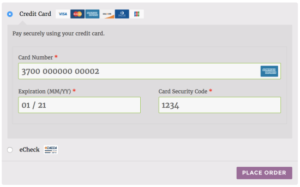

Authorize.net

Authorize.net have been around since forever 🙂 Founded in 1996, I’m pretty sure Authorize.net was the first payment gateway I ever used. Frankly I see very little reason to use them in 2019. That said, there are a few compelling reasons in certain scenarios. For online stores deemed to be high risk by Stripe or Paypal may find Authorize.net more amenable. There are several Authorize.net WooCommerce extensions available depending on your specific requirements. Some of these will require higher levels of PCI compliance.

The most commonly used WooCommerce extension for Authorize.net is the Authorize.net AIM WooCommerce extension.

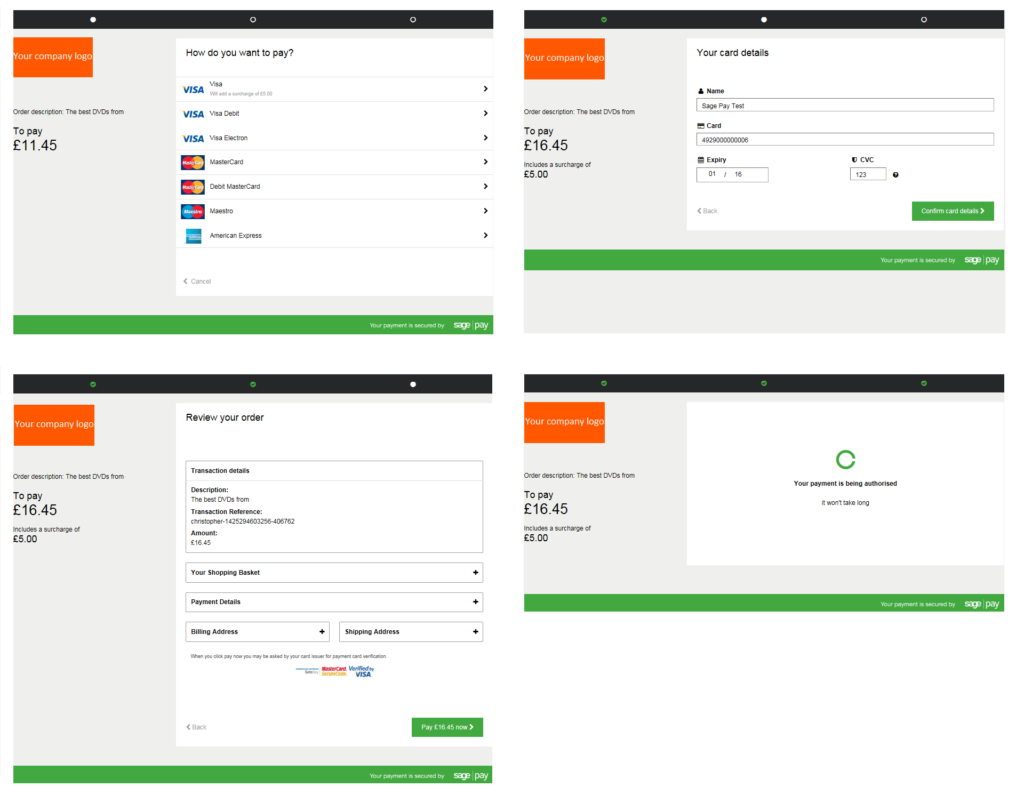

Sagepay – Great option for UK and Ireland WooCommerce store owners

SagePay is a very popular UK based payment gateway. If your online business is based in Europe then SagePay is definitely worth considering. I’ve had many customers over the years use SagePay and have always found their customer support team to be excellent. Like most smaller gateways, their online offering tends to not be as slick as Stripe or Paypal Pro, but they’re constantly improving. The key benefit of a local gateway would usually be lower transaction fees – although that’s not always the case – so it’s best to talk to your bank first to see what options you have. Check out the SagePay for WooCommerce extension.

Wrapping up

There are literally hundreds of payment gateways in operation online. We’ve just scratched the surface of this complex but critical aspect of your online business. The online payment gateway industry is constantly changing with innovators like Stripe being the leaders of the big changes we’ve seen over the past few years. So it’s essential you keep up to date on pricing changes, new features and compliance requirements for each of the big providers. If you’ve any feedback on any of the gateways we’ve featured or some alternative suggestions feel free to let us know in the comments below!

Facebook to shake up eCommerce

Facebook to shake up eCommerce Speeding up checkout with an address autocomplete plugin

Speeding up checkout with an address autocomplete plugin 23 Ways to Prepare Your Online Store for Holiday Sales

23 Ways to Prepare Your Online Store for Holiday Sales Five eCommerce Fundamentals for a successful online store

Five eCommerce Fundamentals for a successful online store